Introduction

In the realm of health and well-being, the specter of critical illnesses such as cancer casts a shadow of uncertainty. The rise in cancer cases and the intricate nature of treatments have prompted the need for specialized coverage. Cancer insurance has emerged as a crucial safeguard against the financial burdens of cancer-related expenses. This article goes beyond the surface to provide a comprehensive perspective on why cancer insurance is a vital asset for both smokers and non-smokers.

Read More –

Comprehensive Guide to Understanding Cancer Insurance: Benefits and FAQs

The 6 Secret Steps to Choosing YOUR Perfect Life Insurance Plan

3 Simple Steps to Instantly Access Your Life Insurance Secrets

Understanding the Significance of Cancer Insurance

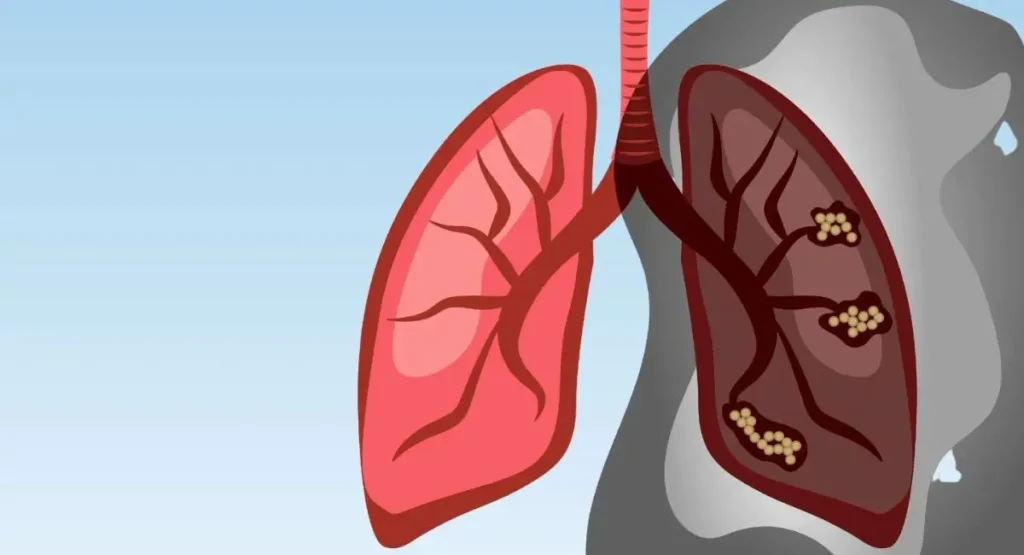

Cancer, a multifaceted disease, demands medical attention that can be emotionally, physically, and financially overwhelming. Cancer insurance, a subset of critical illness insurance, focuses on providing financial support in the event of a cancer diagnosis. It goes beyond traditional health insurance by addressing the specific financial challenges tied to cancer treatment. Let’s delve into five compelling reasons why cancer insurance is essential for both smokers and non-smokers.

1 -Comprehensive Guide to Understanding Cancer Insurance: Benefits and FAQssurgeries to therapies and medications. While health insurance covers medical costs, cancer insurance offers a broader financial safety net. It assists in covering non-medical expenses like travel, accommodation, and alternative treatments that aren’t always covered by standard health plans.

2 – Income Protection for Smokers and Non-Smokers: For both smokers and non-smokers, a cancer diagnosis can potentially lead to an interruption in employment due to treatment and recovery. Cancer insurance often includes provisions for income replacement, ensuring that you can manage your day-to-day expenses even when you’re unable to work.

3 – Tailored Support for Critical Illnesses: While cancer is the primary focus of this insurance, policies often cover a range of critical illnesses. This comprehensive coverage ensures that you’re protected against various health conditions, providing peace of mind to both smokers and non-smokers.

5 – Lump Sum Payout: A distinctive feature of cancer insurance is the lump sum payout upon diagnosis. This financial infusion can be employed according to your specific needs, whether it’s for medical bills, specialized treatments, or maintaining your lifestyle during treatment.

5 – No Smoking-Related Exclusions: Contrary to popular belief, cancer insurance isn’t exclusively designed for smokers. It is available to both smokers and non-smokers. While smokers might face higher premiums due to increased health risks, cancer insurance does not exclude smokers from accessing coverage.

Conclusion

Cancer insurance is a crucial asset that transcends the boundary between smokers and non-smokers. As the prevalence of cancer continues to rise, being prepared for the financial implications of a diagnosis becomes paramount. Both smokers and non-smokers benefit from the security, peace of mind, and comprehensive coverage that cancer insurance provides. By making informed decisions about your insurance needs, you equip yourself with a robust financial safety net that supports you through the challenges of critical illnesses like cancer.