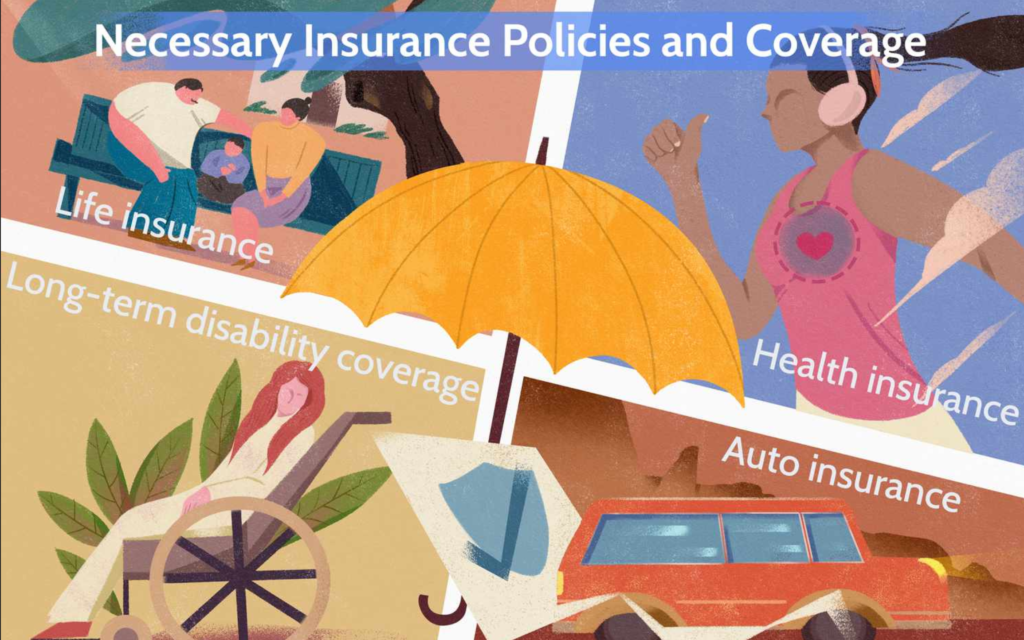

There are many surprises in life. Some, like a car accident or a kitchen fire, are exhilarating, but others, like those, are emotionally and financially catastrophic. That is why a variety of insurance plans are available to aid in the wake of unplanned calamities.

These are the primary categories of insurance coverage to assist you in navigating your choices.

Vehicle Insurance

It is illegal to drive without auto insurance in practically all states. Driving without insurance is not only forbidden, but it can also cost you a lot if you get into an accident—especially if you are at fault. Thankfully, a number of auto insurance plans can cover injuries and vehicle damage following an accident:

liability protection. If you cause an accident and are at fault, this kind of auto insurance covers your injuries and any property damage you cause to other people. In the event that you are sued following an automobile accident, liability auto insurance also covers your legal defense costs and any awards or settlements. To drive legally, you must carry a minimum amount of liability insurance in all states (except from New Hampshire and Virginia).

coverage for uninsured and underinsured drivers (UM). This coverage covers your medical bills and those of your passengers in the event that your vehicle is struck by an uninsured or underinsured motorist. Additionally, pain and suffering as well as lost wages may be covered under uninsured motorist coverage. A few states mandate UM insurance. Additionally, in certain areas, uninsured/underinsured motorist damage to your car may be covered by UM policy.

Protection against personal injury (PIP). Your passengers’ and your own injuries may be covered by PIP insurance, regardless of who caused the collision. In addition, this coverage might pay for services like child care that you are no longer able to provide after an injury, as well as lost income and rehabilitation expenses. PIP is mandated in many places, although it is optional in others and unavailable in still others.

Medical payment coverage. Regardless of who is at fault, MedPay coverage helps cover your medical costs as well as those of your passengers if you are hurt in an accident. The typical range of coverage amounts is $1,000 to $5,000.

both collision and comprehensive insurance. Together, these coverage options help to cover car damage. Regardless of who was at fault, collision insurance covers the cost of replacing or repairing your vehicle after an accident. Theft and damage to your vehicle from fire, hail, floods, vandalism, fallen items, and animal strikes are covered by comprehensive insurance. Comprehensive and collision insurance are optional and are frequently marketed jointly. On the other hand, you will have to purchase your car from your lender if you finance it. This also applies to leases on cars.

Household Liability

There is no state statute requiring homeowners insurance, unlike auto insurance. To safeguard their interest in your property, your lender will typically want coverage if you borrowed money to buy your house. In this manner, you will be able to reconstruct your home in the event of damage or destruction and won’t be able to default on your mortgage.

If anything damages or destroys your home and you don’t have home insurance, you’re still liable for the price of repairs or replacement. This is true even if you paid for your property outright without a mortgage. Purchasing a house insurance coverage is a smart move.

Home insurance plans provide a variety of coverage options, such as:

residence coverage. Dwelling coverage shields your home’s structure from unforeseen calamities like fire, wind, theft, or vandalism, from your roof to your floors. This kind of coverage also covers the cost of replacing or repairing structures that are attached to your home, like a deck or garage. The amount of your dwelling coverage need to match the price of rebuilding your home.

coverage for personal property. Your personal goods, including clothing, appliances, and furniture, are covered by this kind of coverage. Explosions, fires, and thievery are among the issues discussed. Personal property coverage is often limited to a percentage of your home coverage, usually between 50% and 70%. If you require more coverage, you may typically purchase it.

- Other buildings on the grounds. Structures on your land, such as a fence or tool shed, are protected by this kind of coverage.

- covering for liabilities. Any accidental injuries or property damage you cause to other people is covered by liability insurance. Furthermore, in the event of a lawsuit, liability house insurance pays for your legal defense costs. Liability insurance will therefore cover both your legal fees and the visitor’s medical expenses should they fall on your front stairs. Your net worth or the maximum amount that could be garnished from you in a lawsuit should match the amount of liability insurance you have.

- extra costs of living. If a situation covered by your policy causes you to be temporarily evacuated from your home, supplementary living expenses coverage will cover additional costs for things like meals and lodging.

- Recall that earthquake and flood damage is not covered by a typical home insurance policy, but these issues can be covered by additional insurance.

Tenant Protection

You still need insurance even if you don’t own a house. In the event that your furniture, clothing, or electronics are lost, stolen, or destroyed, renters insurance will assist you in replacing them. Explosions, fires, tornadoes, and other issues are discussed.

If your rental property burns down, you wouldn’t have coverage and would have to replace everything. While damage to a rental property’s structure is covered by your landlord’s insurance, tenant property is not. Landlords occasionally demand confirmation of insurance before renting out a property.

Included in renters insurance is:

coverage for personal property. If something like a fire damages or steals your belongings (dishes, clothes, furniture, etc.), this coverage will pay you back.

liability protection. This coverage can cover the expenses incurred if you are held accountable for the bodily harm or property damage of another. For example, if someone falls in your flat due to your negligence, liability insurance can pay for their medical fees.

supplementary assistance for living expenses. This coverage will reimburse your additional expenses while you are unable to live at home if a condition covered by the policy damages or destroys your rental, rendering it uninhabitable.

Insurance Under an Umbrella

Liability coverage is a feature of renters, homeowners, and auto insurance that shields your assets and those of your family from lawsuits. Yet there are liability caps on all policies. Your homeowners, renters, or car liability insurance might not be enough if you lose a costly lawsuit if you own significant assets.

If something unforeseen occurs and you become liable, umbrella insurance might offer extra liability protection. For illustration purposes, suppose someone trips on your walkway, hurts their back, and sues you for $500,000 in medical expenses. You are liable for the remaining $200,000 if your home insurance liability limit is merely $300,000. An umbrella policy would pay for this additional expense.

Life Assurance

It’s critical to acquire the finest life insurance for your circumstances if you are the primary provider for anyone. In the event that the major wage earner passed away, 44% of American households would experience financial trouble within six months; for 28%, According to industry-funded research organization LIMRA, it would only take one month. One option for replacing your income in the event of an untimely death is life insurance.

Term life insurance and permanent life insurance are the two primary categories into which life insurance policies often fall.

Also Read: Why Insurance Matters in 2024: Safeguarding Your Future

Term life insurance

You can fix rates for a specific period of time, such as 10, 15, 20, or 30 years, with term life insurance. You will pay level premiums over this period. You can usually renew the policy annually after the level term period expires, but the cost will increase each time.

Term life insurance might be a viable option for you if you want to pay for a specific financial commitment, such as college expenses or debt. The least expensive kind of life insurance is often term life insurance.

Enduring life protection

Lifelong protection is possible with permanent life insurance. Permanent life insurance provides a cash value component in addition to the death payout. You can access the money by taking out a loan or withdrawing cash if the cash value increases. You can claim the policy’s cash value (less any surrender charges) if you choose to cancel it.

If you want to provide a death benefit for someone who will be financially dependent on you for an extended length of time, or if you want to develop cash value to supplement retirement funds, think about getting permanent life insurance. Term life insurance is less costly than permanent life insurance.

Whole life insurance is one type of permanent life insurance. Whole life, universal life, variable life, and burial life insurance are among the varieties of permanent life insurance.

Also Read: How much does health insurance cost in 2024?

Health Benefits

Financial hardship in America is often caused by medical bills, as reported by the American Public Health Association. A three-day hospital stay may set you back almost $30,000, even if you’re young and in good condition, according to Healthcare.gov. Your money could be severely harmed if you lack insurance.

Typically, your company offers health insurance plans. You can browse health insurance plans on the federal health insurance marketplace if your employer does not provide health insurance or if you do not have a job. Subsidies for federal marketplace health insurance plans are available if you meet certain eligibility and income conditions.

Alternatively, you can purchase health insurance by getting in touch with providers directly or via a broker or agency.

Check into the price of a high deductible health plan if the monthly charges seem excessive. This kind of coverage can save your monthly health insurance costs, but it will need you to pay a higher deductible prior to coverage beginning.

Furthermore, you can combine a Health Savings Account with a high deductible insurance plan to save tax-free money for future medical expenses.

Generally, the only times you can get health insurance are during open enrollment periods that are set by the health insurance providers. Marketplace plan open enrollment typically runs from November 1 to December 15, however certain states may extend this date.

You may be eligible for an exception to the open enrollment period if you’ve just had a significant life event, like getting married or having a child.

Insurance for Disability

It’s possible that you believe disability insurance is only necessary if your line of work involves risky tasks. However, not all disabilities are related to one’s job. The Council for Disabilities Awareness lists back pain, diabetes, cancer, and arthritis as some of the leading causes of disability. For this reason, it makes sense to incorporate disability insurance into your overall financial strategy.

Disability insurance augments your income in the event of illness or disability that prevents you from working. It normally replaces between 40% and 70% of your base pay, has a waiting period before coverage begins, and has a monthly payment ceiling.

There are two primary ways to obtain disability insurance, aside from being eligible for Social Security disability benefits:

- Work-related group disability insurance

- rules for individual disabilities that you acquire independently

Insurance for Long-Term Care

The Department of Health & Human Services estimates that adults turning 65 have a 70% risk of requiring long-term care at some point. Most seniors will probably require assistance at some point in their lives, whether it be for a prolonged stay in a nursing home or for help with daily duties around the house. Moreover, long-term care is expensive. The average monthly cost of a private room in a nursing home is $9,000, according to Genworth, a company that offers long-term care and life insurance.

Expenses for in-home care, adult day care, or stays in nursing homes may be partially covered by long-term care (LTC) insurance. The ideal age range to purchase long-term care insurance is between 50 and 60 years old. This age bracket is typically the most economical time to purchase coverage. The cost of long-term care insurance will rise as you become older.

Make sure you do a lot of research on this product before purchasing it. Large rate rises in recent years have caught policyholders off guard and rendered the insurance unaffordable for many even after they had purchased it. An overview of long-term care insurance is available from the Congressional Research Service.

When purchasing life insurance, you might be able to purchase a policy that combines life insurance and long-term care (LTC) coverage, or you might be able to add LTC coverage as a rider to your existing policy.