Purchasing a home is an important investment for many adults, and it’s equally important to protect that investment. If you own a home, you know that homeowners insurance is a necessary expense — and it can be a costly one at that. The peace of mind that comes with knowing you’re covered in the event of an accident is priceless, but that doesn’t mean insurance premiums don’t take a financial toll on your budget.

In the U.S., the national average cost for homeowners insurance is $1,015 a year. But annual premiums for homeowners insurance can vary by hundreds of dollars depending on the company you choose, your home’s location, and the specific policy details and limits you opt for. Fortunately, it’s possible to save money without forgoing any necessary protective measures in your policy. Use these helpful tips to lower your premium costs while still keeping yourself fully covered.

You shouldn’t necessarily purchase a policy from the first insurance company you contact. Shop around at multiple companies to get quotes on a homeowners insurance policy before committing to one. Many companies charge different rates for similar coverage levels, so checking with several might help you save hundreds of dollars a year. Get quotes from at least three or four insurers. You can do this easily online, but you may also prefer to speak with agents on the phone.

It’s also helpful to check with your state’s insurance commissioner to find out the average homeowner premium rates in your area. These can provide a range of costs to help you better anticipate what’s acceptable.

Make Sure You’re Getting Discounts If You’re Eligible

Homeowners insurance comes with plenty of potential discounts. Many of them aren’t things you might already know about, so ask your insurance agent about what’s available to see if you’re eligible. For example, some insurance companies offer discounts for being a new homeowner, for paying the annual premium in full from the start, for signing a longer contract with the insurance company, for using auto-pay or for choosing paperless billing. Additionally, you might qualify for a discount on your premium if nobody in your home uses tobacco, your home was built recently or you’re employed in a certain profession.

Choose a Higher Deductible

The lower your deductible is, the higher your homeowners insurance premium will be. Choosing a higher deductible can lower what you pay annually. This is because you’re taking on more of the risk by paying a higher deductible, should you need to file a claim.

Be careful, though. When deciding on your deductible, consider how much you’ll reasonably be able to pay out of pocket for repairs to avoid putting yourself in debt or losing the money you saved on having a higher deductible in the first place.

Make Improvements to Your Home

Making your home more resistant to damage, particularly from natural disasters, is a great way to reduce the cost of your homeowners insurance. Home improvements like adding storm shutters, upgrading your roof to be more impact-resistant, modernizing heating and electrical systems to prevent fires, and modernizing plumbing to avoid flood damage are some examples of home improvements that can lower homeowners insurance premiums. Additionally, consider installing hurricane-resistant windows, adding smoke detectors throughout your home or getting a sprinkler system to reduce fire damage.

Keep in mind that you might need a new home inspection to evaluate your home improvements in order for any potential discounts to apply. Also consider the types of disasters that are more common in your area. It doesn’t make sense to invest in hurricane windows if your state isn’t prone to these weather events, and you might not receive a discount.

Improve Your Home Security

Many insurance companies offer reduced premiums to homeowners who utilize advanced home security systems. Installing things like deadbolt locks, burglar alarms and monitored security systems are examples of advanced home security. Some security systems can be quite expensive, so it’s best to discuss the types of discounts you could become eligible for before committing to an installation if the primary purpose is to lower your homeowners insurance premium. That way, you can figure out if the investment is ultimately worth it.

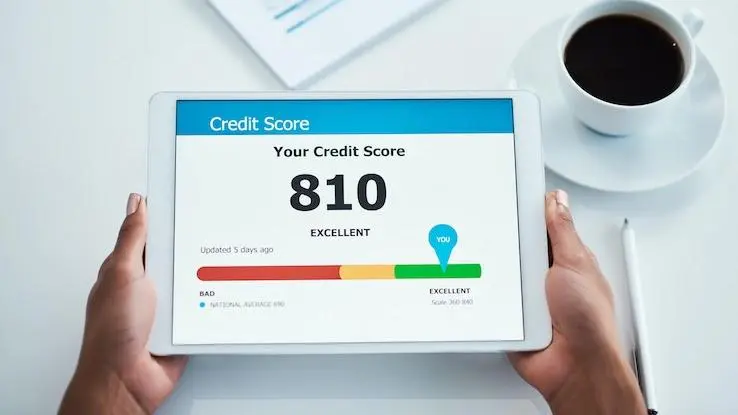

Be Mindful of Your Credit Score

Your credit score can play a significant role in the cost of your homeowners insurance. In certain states, companies use your credit score specifically to help determine the rate you pay. A credit score below the mid-600s is likely to trigger a higher premium. Keeping yours above that score is a straightforward way to ensure you’re not paying as much for your homeowners insurance.

If your score is low, take a close look at your credit report to figure out why. Then, you can start to improve your credit, lower your insurance costs and enjoy the other benefits that come along with a good score.

Avoid Making Claims for Small Damages

Filing a claim for a minor, inexpensive incident usually isn’t a wise idea as far as homeowners insurance premiums are concerned. Insurers often give discounts to clients who stay claim-free for a specific amount of time, which is typically a few years. As such, paying for these smaller repairs out of pocket could save you money in the long run by helping you obtain a lower insurance premium.

Insure Your Home and Vehicle With the Same Company

Insurance companies tend to give deals to clients who bundle their home and auto insurance policies together. The savings vary but can sometimes exceed 20% of the premium. Additional savings might be available when you do even more bundling. If you plan to insure a boat, jewelry or other expensive household items, you might be able to get an even larger policy discount.

Remove High-Risk Features and Structures From Your Property

In insurance law, there’s a type of property feature called an “attractive nuisance.” This describes anything manmade that could attract a child to your property, such as a swimming pool, trampoline or playground equipment. Having an attractive nuisance on your property can raise your homeowners insurance premium. Check with your insurance agent and consider removing these features if you want to save some money, particularly if you or your own children no longer use them.

Eliminate Unnecessary Coverage

Periodically check over your homeowners insurance policy to make sure it’s still aligned with your desired coverage provisions and levels. Removing coverage that’s become unnecessary can help reduce the cost of your premium. Also, if the value of your home went down due to market conditions or aging, the total loss coverage determined in your policy will probably decrease too. It’s important to discuss these issues with an insurance agent.

Shop Around Again Every Year or Two

Even if you’re not necessarily planning to change insurance companies, you can leverage your own premiums by knowing what other insurers are charging for the same coverage. Things might have changed since you originally shopped around for homeowners insurance. If you find that another company offers a lower rate, talk to your insurance agent about matching it or even besting it to see if you can negotiate a lower rate.